The $500 Difference: How Maine’s My Alfond Grant Program Implemented Universal Early Wealth Building

Colleen J. Quint

President & CEO, Alfond Scholarship Foundation

Harold Alfond, a Maine businessman and philanthropist, had a vision that every Maine child should have a seed investment to spark a bright future. His motivation was to make a difference for each child through a financial investment that could grow over time and be used for higher education. He also wanted to build a more educated workforce to ensure the future prosperity of the state. So, in 2008, Mr. Alfond made a commitment to invest $500 at birth for every baby born a Maine resident.

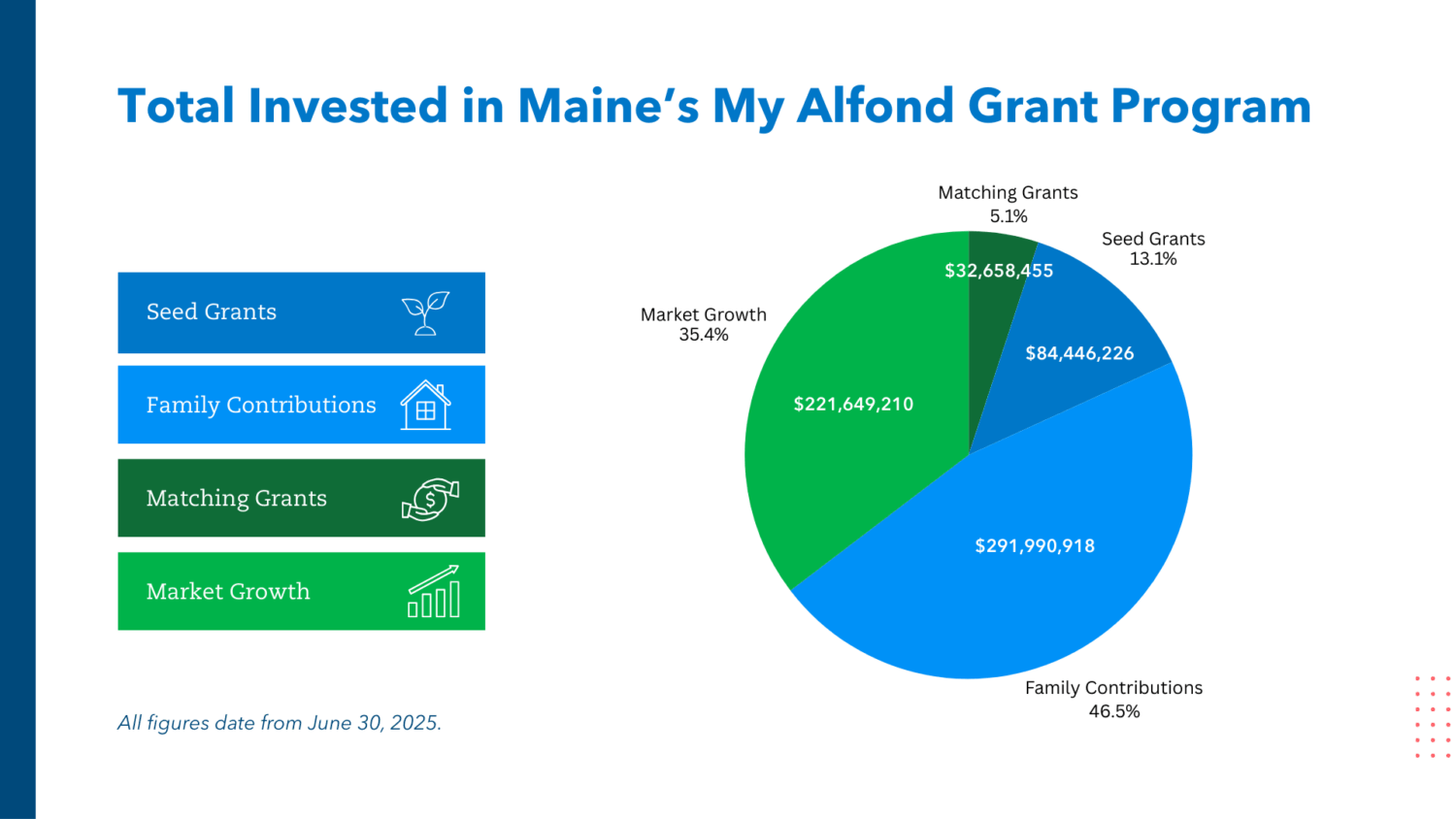

Through the My Alfond Grant program—which is managed by the Alfond Scholarship Foundation and administered with the help of the Finance Authority of Maine (FAME)—more than $630 million is now invested for the future education of some 170,000 Maine children, with 100 percent of Maine children receiving the grants over the last 12 years.

The newly created Trump Accounts included in the budget reconciliation act (also known as the One Big Beautiful Bill Act, or H.R. 1) signed by the president in July 2025 mirror the potential to benefit children across the country just as Mr. Alfond has done in Maine. Lessons learned from Maine’s experience with its My Alfond Grant program can help inform the Trump Account pilot program, increase its scale, and ensure that the commitment achieves the vision and impact that’s possible with these kinds of early investments.

Automatic enrollment

Perhaps the biggest lesson learned from the Alfond Grant program is the importance of automatic enrollment. When the program launched in 2008, it used an “opt-in” model. Families were required to open a NextGen529 account—Maine’s education savings plan—by the child’s first birthday in order for the Alfond Grant to be awarded. Over the first five years of opt-in enrollment, about 35 percent of eligible children had accounts opened on their behalf and received the $500 Alfond Grant. At its peak opt-in year in 2012, about 40 percent of eligible children were awarded an Alfond Grant. About 25,000 Maine children were awarded an Alfond Grant during this time—a strong outcome, but it also meant that 60 percent of Maine children were still missing out.

Ultimately, the foundation decided it was more important that children actually had the grant—not just the opportunity to have it. In 2013 the program pivoted to automatic enrollment.

To make the move to universal and automatic enrollment, the Alfond Scholarship Foundation opened an omnibus account into which funds are invested for each “cohort” of babies born in a particular month (e.g. all the babies born as Maine residents in June 2025). The value of the $500 for members of each cohort is tracked over time so that any child with an Alfond Grant can easily see how much their grant is worth. For the oldest grant recipients—who will enter their senior year of high school in fall 2025—that $500 is now worth about $2,250.

There are, of course, other platforms or models that could be used to implement automatic enrollment. But the key is to have some sort of process of automated account opening to make sure they reach all eligible children. The proof is in the data: After switching to automatic enrollment, 100 percent of Maine resident babies now receive the Alfond Grant.

After switching to automatic enrollment, 100 percent of Maine resident babies now receive the Alfond Grant.

Accruing contributions

An important feature that both the My Alfond Grant program and Trump Accounts share is the ability for families and others to make additional contributions over time. In the case of the My Alfond Grant program, families must open their own account, such as a 529, to make contributions, enabling them to control their own investment choices and expenditure decisions.

This was a critical design element from the inception of the My Alfond Grant program, and it has paid tremendous dividends both in terms of family engagement with the program and actual dollars invested. In fact, families, as well as employers, community organizations, and philanthropic organizations, have now contributed more than three times what the foundation has invested in seed dollars. These funds from additional sources—sometimes referred to as “multiple streams of assets” or the “capital stack”—mean that not only are more assets invested early in a child’s life but also that children and families experience the kind of community support that builds aspirations.

Ongoing Learnings

Over the last 12 years, Maine has seen the benefits of early investments in children:

- An at-birth program provides an 18-year platform to build aspirations and financial literacy. More than a dollar amount, the accounts give all families a meaningful ownership stake in the economy.

- Families open their own accounts for their contributions when both the parents and the children are younger, giving more time for contributions to be made and more time for the markets to build even greater capital through investment returns.

- Like Trump Accounts and Alfond Grants, programs should strongly consider investing funds in capital markets, which with a long time horizon can contribute to long-term growth and larger account balances for young people to build wealth.

- State and local partnerships with College Savings Account and other early wealth-building programs like My Alfond Grant can help to raise visibility of and engagement with Trump Accounts, especially for low- and moderate-income families.

- Alfond Grants benefit from public-private partnerships. While Maine’s program receives initial seed dollars from the Harold Alfond Foundation, additional contributions from multiple sources—such as matching grants from FAME—mean not just more dollars invested but also more partners in early wealth building. Like Alfond Grants, the federally seeded Trump Accounts can benefit from public-private partnerships.

Trump Accounts have great potential to build real assets for children over time. Having this additional resource from birth—assuming it builds on, and does not sacrifice or diminish, the backbone of financial access and stability that programs like Pell Grants and Social Security have provided for generations—could meaningfully boost resources for a financially stable future.

The national scale of Trump Accounts provide an exciting new opportunity. To make the most of this opportunity—and to reap the benefits at the individual and societal level—will require additional elements embedded into the model. Truly automatic enrollment is the right place to start.