Overview

Scenario and Sensitivity Analysis

Scenario and sensitivity analysis are critical tools for financial professionals to evaluate uncertainty, model risks, and make informed decisions. This course teaches how to build dynamic Excel models that adapt to multiple business cases, test key assumptions, and identify the variables with the greatest impact on outcomes. You’ll learn to use data tables, scenario managers, and visual tools like charts to communicate financial implications clearly. Whether working in investment banking, FP&A, or valuation, this course equips you to deliver more insightful, decision-ready analysis.Learning Objectives

- Build a dynamic scenario manager for different business cases.

- Create outputs that clearly show which variables have the greatest impact.

- Integrate sensitivity analysis using Excel best practices.

Who should take this course?

This course is ideal for finance professionals, analysts, and learners pursuing careers in investment banking, corporate finance, equity research, or financial planning and analysis (FP&A).

Scenario & Sensitivity Analysis in Excel Learning Objectives

- Build a dynamic scenario manager for different business cases.

- Create outputs that clearly show which variables have the greatest impact.

- Integrate sensitivity analysis using Excel best practices.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial modelling

- Basic data analysis

Scenario & Sensitivity Analysis in Excel

Level 3

49min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

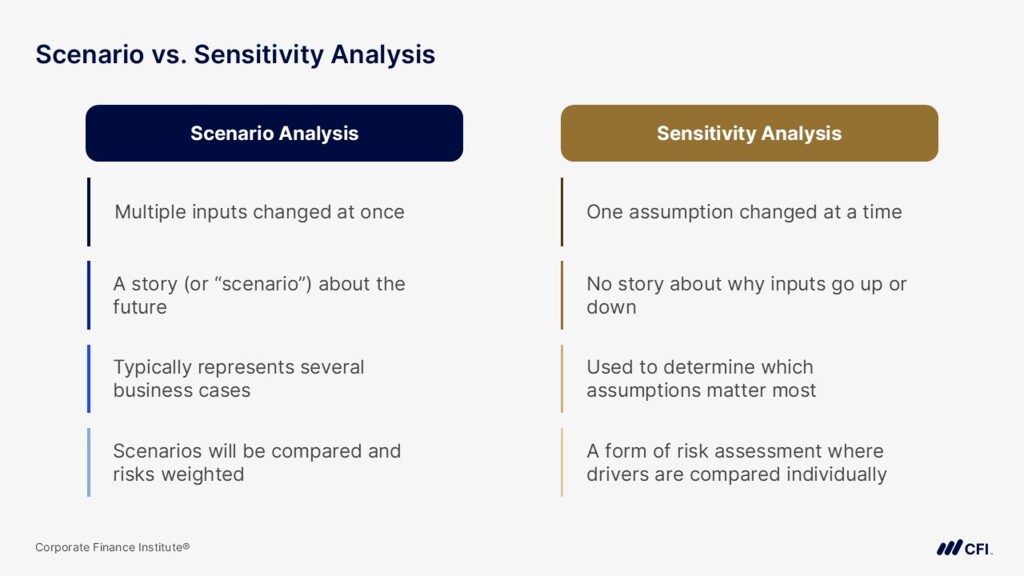

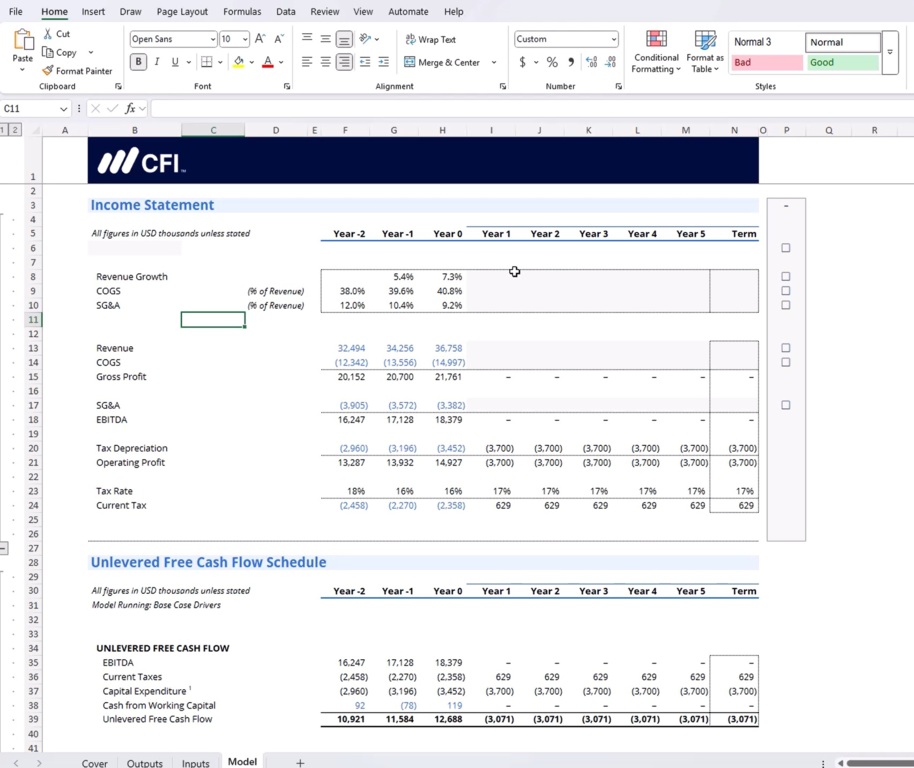

Scenario Analysis

Sensitivity Analysis

Presenting Results

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Financial Planning & Analysis Professional

- Skills You’ll Gain Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, Data Visualization, Economics, and more

- Great For The FPAP certification focuses on practical, desk-ready skills that are immediately applicable to current FP&A professionals or anyone seeking to land a role in FP&A