Consumer debt is ubiquitous. Although at any given time some Americans are debt-free, most of us carry debt some or even all of the time. We borrow for various reasons, and we are increasingly likely to incur debt from non-loan sources (such as an out-of-pocket medical expense or being hit with a governmental fine or fee). While consumer debt is not inherently bad, it is a concern today because it has reached record levels, and its effects reach deeply into financial security, physical and mental health, as well as the broader economy. Consumer debt is a systemic problem with significant consequences, but there are systemic solutions.

For the past year Aspen’s Financial Security Program, through the Expanding Prosperity Impact Collaborative (EPIC), has researched the drivers of rising consumer debt, identified a series of challenges that systematically turn debt into a source of deeply consequential financial insecurity for millions of households, and developed a framework for solving these problems.

On November 14th, Aspen EPIC released the Consumer Debt Solutions Framework, which identifies seven specific consumer debt problems – all amenable to solutions – that result in financial insecurity and damage well-being. The event also featured two panel discussions: the first explored the causes and consequences of harmful consumer debt from the perspective of consumers and community leaders; the second showcased the work of public and private sector innovators who are leading the way on solutions to various aspects of the consumer debt problem.

SPEAKERS

Panel 1: Listening to Community Leaders

- Sue Berkowitz – Director, South Carolina Appleseed

- Daniel Bowes – Senior Attorney, North Carolina Justice Center

- Rosazlia Grillier – Co-Chair, POWER-PAC Illinois “Stepping Out of Poverty” Campaign

Panel 2: Discussing Solutions

- Jerry Nemorin – Founder & CEO, LendStreet

- Alex Smith – Chief HR Officer, City of Memphis

- Anne Stuhldreher – Director of Financial Justice, The City and County of San Francisco

- Katherine Lucas McKay – Program Manager, Aspen Financial Security Program

RECAP

SHARE

![]() New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH

New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH![]() Consumer debt is a systemic problem with systemic solutions. New Solutions Framework from #AspenEPIC has identified solutions for stakeholders in every sector & for cross-sector partnerships. https://buff.ly/2RWqHVP

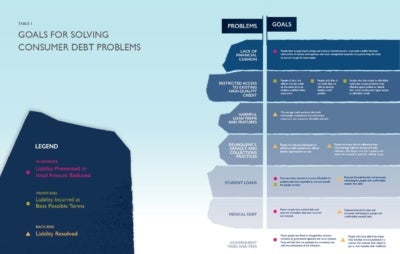

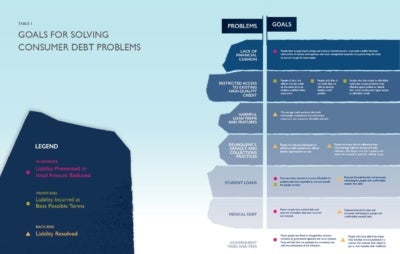

Consumer debt is a systemic problem with systemic solutions. New Solutions Framework from #AspenEPIC has identified solutions for stakeholders in every sector & for cross-sector partnerships. https://buff.ly/2RWqHVP![]() #AspenEPIC’s research identified seven specific consumer debt problems that result in financial insecurity and damage well-being, and all are amendable to solutions. Read the full solutions framework: https://buff.ly/2RWqHVP

#AspenEPIC’s research identified seven specific consumer debt problems that result in financial insecurity and damage well-being, and all are amendable to solutions. Read the full solutions framework: https://buff.ly/2RWqHVP

Lifting the Weight: Consumer Debt Solutions Framework

Consumer debt is ubiquitous. Although at any given time some Americans are debt-free, most of us carry debt some or even all of the time. We borrow for various reasons, and we are increasingly likely to incur debt from non-loan sources (such as an out-of-pocket medical expense or being hit with a governmental fine or fee). While consumer debt is not inherently bad, it is a concern today because it has reached record levels, and its effects reach deeply into financial security, physical and mental health, as well as the broader economy. Consumer debt is a systemic problem with significant consequences, but there are systemic solutions.

For the past year Aspen’s Financial Security Program, through the Expanding Prosperity Impact Collaborative (EPIC), has researched the drivers of rising consumer debt, identified a series of challenges that systematically turn debt into a source of deeply consequential financial insecurity for millions of households, and developed a framework for solving these problems.

On November 14th, Aspen EPIC released the Consumer Debt Solutions Framework, which identifies seven specific consumer debt problems – all amenable to solutions – that result in financial insecurity and damage well-being. The event also featured two panel discussions: the first explored the causes and consequences of harmful consumer debt from the perspective of consumers and community leaders; the second showcased the work of public and private sector innovators who are leading the way on solutions to various aspects of the consumer debt problem.

SPEAKERS

Panel 1: Listening to Community Leaders

- Sue Berkowitz – Director, South Carolina Appleseed

- Daniel Bowes – Senior Attorney, North Carolina Justice Center

- Rosazlia Grillier – Co-Chair, POWER-PAC Illinois “Stepping Out of Poverty” Campaign

Panel 2: Discussing Solutions

- Jerry Nemorin – Founder & CEO, LendStreet

- Alex Smith – Chief HR Officer, City of Memphis

- Anne Stuhldreher – Director of Financial Justice, The City and County of San Francisco

- Katherine Lucas McKay – Program Manager, Aspen Financial Security Program

RECAP

SHARE

![]() New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH

New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH![]() Consumer debt is a systemic problem with systemic solutions. New Solutions Framework from #AspenEPIC has identified solutions for stakeholders in every sector & for cross-sector partnerships. https://buff.ly/2RWqHVP

Consumer debt is a systemic problem with systemic solutions. New Solutions Framework from #AspenEPIC has identified solutions for stakeholders in every sector & for cross-sector partnerships. https://buff.ly/2RWqHVP![]() #AspenEPIC’s research identified seven specific consumer debt problems that result in financial insecurity and damage well-being, and all are amendable to solutions. Read the full solutions framework: https://buff.ly/2RWqHVP

#AspenEPIC’s research identified seven specific consumer debt problems that result in financial insecurity and damage well-being, and all are amendable to solutions. Read the full solutions framework: https://buff.ly/2RWqHVP